Introduction

Prompt engineering salaries are all over the map. Titles vary ("Prompt Engineer," "AI Engineer," "LLM Engineer"), and comp structures mix base, bonus, and equity in ways that can be tough to compare. This guide teaches you, step-by-step, how to research the market, normalize the data, build a realistic target range, and negotiate like a pro.

What You Need Before You Start

- A simple spreadsheet (columns for source, title, company, location, level, base, bonus, equity, source date, notes)

- Accounts for salary sites: Levels.fyi, Glassdoor, Payscale, Indeed

- Cost-of-living data: BEA Regional Price Parities

- A few current job descriptions matching your scope, plus any recent comp conversations/offers

Title keywords to widen your search

| Primary Search | Adjacent Titles | Why It Helps |

|---|---|---|

| Prompt Engineer | AI Engineer, LLM Engineer, Generative AI Engineer | Many companies avoid the term "prompt" in titles but expect the skill set. |

| Applied NLP | ML Engineer, Conversational AI, RAG Engineer | Overlapping responsibilities and comp bands; useful for triangulation. |

| AI Product Engineer | Full-Stack AI, MLE (Product) | Blended roles with similar seniority and total comp structures. |

The Steps

-

Clarify your role scope (before you price it).

Write down what you actually do (or will do): prompt design, evaluation frameworks, RAG pipelines, fine-tuning, observability, safety and red-teaming, or AI product integration. Align scope with seniority (IC vs. lead), and note expected impact (prototype vs. production). The clearer your scope, the tighter your comp range. -

Collect salary signals from multiple sources.

Triangulate instead of trusting a single site. Start with:- Levels.fyi for tech comp benchmarks and H-1B filings

- Glassdoor and Payscale for crowd-sourced ranges

- Indeed and job posts with pay transparency (many states require it)

- Bureau of Labor Statistics for software developer baselines (useful when title data is sparse) Record role title, company, location, date, and total comp details. Keep raw notes; you’ll normalize next.

-

Normalize the data so you can compare apples-to-apples.

- Standardize timeframes: convert hourly to annual (hourly × 2,080). Note contractor vs. W-2.

- Adjust for location using BEA Regional Price Parities; focus on purchasing power, not just cash.

- Note company stage (startup vs. public) and level (junior, mid, senior, staff).

- Separate remote roles: many firms geo-index pay. Capture "remote-from" location and employer policy.

-

Break down total compensation (and annualize equity).

Total Comp = Base + Bonus + Equity (annualized) + Other (sign-on, stipends).- Base: recurring salary.

- Bonus: target and actual; note if guaranteed in year one.

- Equity: if RSUs, annualize using grant / 4 (typical 4-year vest). If options, estimate conservatively (use current 409A/fair market value and apply a haircut).

- Other: sign-on bonuses, relocation, education budgets, hardware, on-call pay.

-

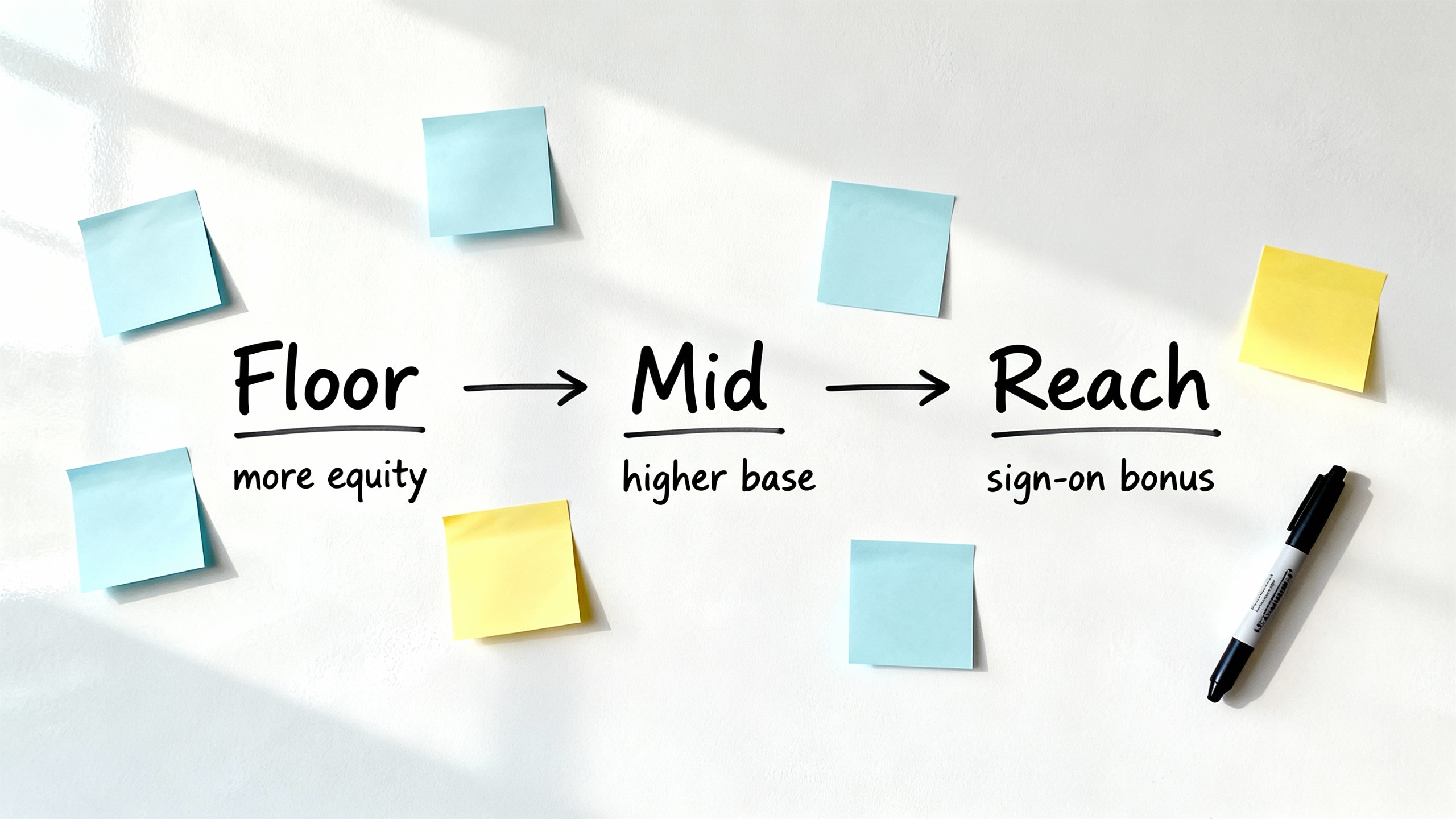

Build your target range (floor, mid, reach).

Use your normalized data to create a three-point range:- Floor: the number you won’t go below (covers your needs and market minimum).

- Mid: fair market median for your scope and location.

- Reach: ambitious but defensible (skills scarcity, impact, competing offers).

Back your range with 3–5 sources. If you’re early-career, weight transparent job-post ranges more; if senior, weight Levels.fyi benchmarks and recent offers more.

-

Pressure-test with humans.

Do two quick loops:- Recruiters: ask for the band for your level and location; confirm how equity is valued.

- Peers you trust: "For a role doing X, Y, Z at a Series B in NYC, does $A–$B TC feel right?"

If the feedback consistently says you’re high or low, adjust. Keep notes in your spreadsheet.

-

Negotiate with a plan (and timing).

- Defer numbers until you understand scope and impact. If pressed: "I’m focused on fit first—happy to discuss ranges after we align on responsibilities."

- Anchor with your mid-to-reach range, grounded in sources: "Based on Levels.fyi, published ranges in CA/NY, and two recent offers, I’m targeting $X–$Y TC for this scope."

- Trade, don’t plead: If base is tight, ask to increase equity, sign-on, or level; propose earlier refresh or performance review at six months.

- Get it in writing and ask about refresh schedules, promotion timelines, and geo-pay policy for remote roles.

-

Keep a living comp log.

Markets move fast. Update your sheet quarterly with new data points, transparency laws, and your growing skills (eval tools, RAG, safety, latency optimization). This makes future negotiations easier—and faster.

Pro Tips and Common Mistakes

TipNormalize by scope, not buzzwords

When titles are fuzzy, map responsibilities to a known ladder (e.g., MLE IC2/IC3). Then price against that ladder using multiple sources.

- Don’t ignore equity math. RSUs and options can dwarf base pay—annualize and compare total comp.

- Save receipts. Screenshots of ranges in job posts and recruiter emails help justify your ask.

- Compare purchasing power, not just dollars. A $180k role in a high-cost city might be equivalent to $150k elsewhere after RPP adjustments.

Conclusion

You don’t need a crystal ball to answer "What does a prompt engineer earn?"—you need a method. Define your scope, gather multiple signals, normalize for location and equity, build a defensible range, and negotiate with trade-offs. Do this once, keep your data fresh, and every conversation gets easier—and more lucrative.