What was announced

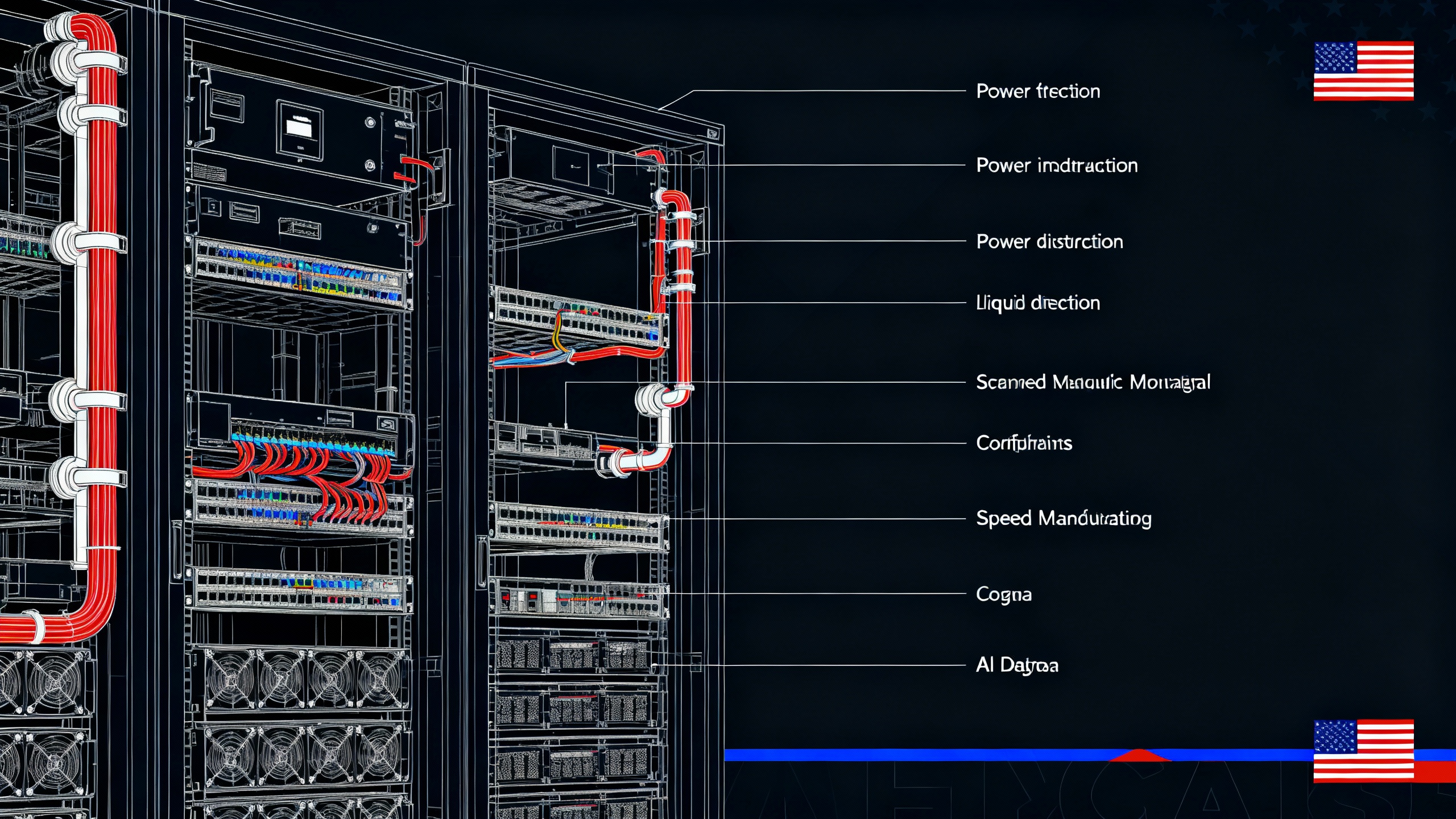

OpenAI and Hon Hai Technology Group (Foxconn) unveiled a collaboration to co‑design next‑generation AI data‑center racks and manufacture key components in the United States. The initial pact focuses on design work, U.S. manufacturing readiness, and early evaluation rights for OpenAI—without purchase or financial commitments at this stage. Foxconn says it will build critical gear such as cabling, networking, cooling, and power systems at its U.S. facilities to speed deployments and strengthen a domestic AI supply chain. OpenAI, Foxconn press release, Reuters.

OpenAI frames the move as part of a broader push to “reindustrialize America.” As CEO Sam Altman put it, “This partnership is a step toward ensuring the core technologies of the AI era are built here.” OpenAI.

What’s in the OpenAI‑Foxconn deal

| Element | What’s confirmed |

|---|---|

| Scope | Co‑design and U.S. manufacturing readiness for multiple generations of AI racks |

| Early access | OpenAI can evaluate and has an option to purchase |

| Purchase commitments | None in the initial agreement |

| U.S. build | Foxconn to make cabling, networking, cooling, and power systems in the U.S. |

| Supply‑chain goal | Designs that can be manufactured “across the U.S.” to broaden domestic sourcing |

| Adjacent news | Foxconn–Intrinsic JV to accelerate robotics/automation on U.S. factory floors |

Sources: OpenAI, Foxconn, Intrinsic, Reuters.

Why it matters for automation and the AI economy

- Faster rollouts: Standardizing multi‑generation rack designs with Foxconn’s high‑volume manufacturing could compress time‑to‑capacity for new clusters.

- Domestic resilience: U.S. production of rack infrastructure helps diversify supply, mitigate tariff risk, and reduce long‑distance logistics for heavy gear. Reuters.

- Factory automation tailwind: Foxconn’s new joint venture with Alphabet’s Intrinsic aims to bring more adaptable, AI‑driven robotics to electronics assembly—the very lines that build server racks. Intrinsic.

How “U.S.-made” could take shape

Foxconn already manufactures AI servers in America and is expanding that footprint, including a Houston site that will deploy advanced robotics to build NVIDIA systems; the company also maintains facilities in Wisconsin and Ohio that AP notes as part of its U.S. base. Reuters, AP.

- Near‑term: Expect U.S. output of power and networking gear, cabling harnesses, and potentially rack‑level cooling subsystems.

- Medium‑term: The Foxconn–Intrinsic JV suggests more flexible automation (assembly, inspection, machine tending, logistics) that can adapt as rack designs iterate. Intrinsic.

- Regional spread: OpenAI and partners have identified multiple U.S. data‑center sites across Texas, New Mexico, Wisconsin, and Ohio under the Stargate banner, creating local demand for nearby manufacturing. OpenAI.

For CIOs and builders: What to watch

- Interoperability and lead times: Will the co‑designed racks embrace open standards that make it easier to mix accelerators (NVIDIA today, plus AMD and custom silicon later)? OpenAI has parallel chip partnerships with AMD and Broadcom that point to a multi‑vendor future. AP, Reuters.

- Power and cooling envelopes: AI racks are climbing in density; plan around facility‑level upgrades for power distribution, liquid cooling, and serviceability.

- Domestic supply chain SLAs: U.S. manufacturing could shorten logistics and service windows—use that to negotiate tighter SLAs once product SKUs are published.

TipProcurement checklist

- Ask for published thermal and electrical profiles per rack generation.

- Validate parts localization: What percentage of BOM is sourced and assembled in the U.S.?

- Check multi‑vendor accelerator support and NIC/cabling standards.

- Clarify upgrade paths between rack generations (retrofit vs. swap).

- Align delivery schedules with grid capacity and cooling buildouts.

Risks and open questions

- No orders yet: The announcement is design‑ and manufacturing‑readiness first; commercial volumes depend on later decisions. OpenAI, Reuters.

- Track record scrutiny: Foxconn’s high‑profile Wisconsin LCD project was dramatically scaled back under a revised deal in 2021—context many U.S. stakeholders will remember as they evaluate new timelines and incentives. CNBC.

- Power constraints: AI data centers are a fast‑rising load on U.S. grids. Industry estimates and policy moves (e.g., demand‑response deals) signal that energy availability could be the gating factor for new capacity. Pew Research, Gartner, Reuters.

Big picture

OpenAI’s Foxconn tie‑up moves the AI race from cloud renderings to factory floors. It’s an early‑stage, design‑first alliance—but it points toward a U.S. manufacturing base that can deliver rack‑level gear at the speed frontier AI demands. For teams building AI products or planning capacity, the message is clear: secure power, diversify hardware, and be ready to plug into U.S.-made infrastructure as it comes online.

Sources

- OpenAI: OpenAI and Foxconn collaborate to strengthen U.S. manufacturing across the AI supply chain (Nov 20, 2025)

- Foxconn: Hon Hai Technology Group (Foxconn) and OpenAI Collaborate To Strengthen U.S. Manufacturing Across AI Supply Chain (Nov 21, 2025)

- Reuters: Foxconn, OpenAI partner on AI hardware manufacturing (Nov 20, 2025)

- AP: OpenAI and Taiwan’s Foxconn to partner in AI hardware design and manufacturing in the US (Nov 20, 2025)

- OpenAI: Stargate advances with 4.5 GW partnership with Oracle (Jul 22, 2025)

- OpenAI: OpenAI, Oracle, and SoftBank expand Stargate with five new AI data center sites (Sept 23, 2025)

- Reuters: Foxconn to deploy humanoid robots at Houston AI server plant (Oct 29, 2025)

- Intrinsic: Foxconn and Intrinsic launch joint venture to build the AI factory of the future (Nov 20, 2025)

- CNBC: Foxconn mostly abandons $10 billion Wisconsin project (Apr 21, 2021)

- Pew Research Center: What we know about energy use at U.S. data centers amid the AI boom (Oct 24, 2025)

- Gartner: Electricity demand for data centers to grow 16% in 2025 and double by 2030 (Nov 17, 2025)